Improve credit quality and convert more enquiries in days, not months

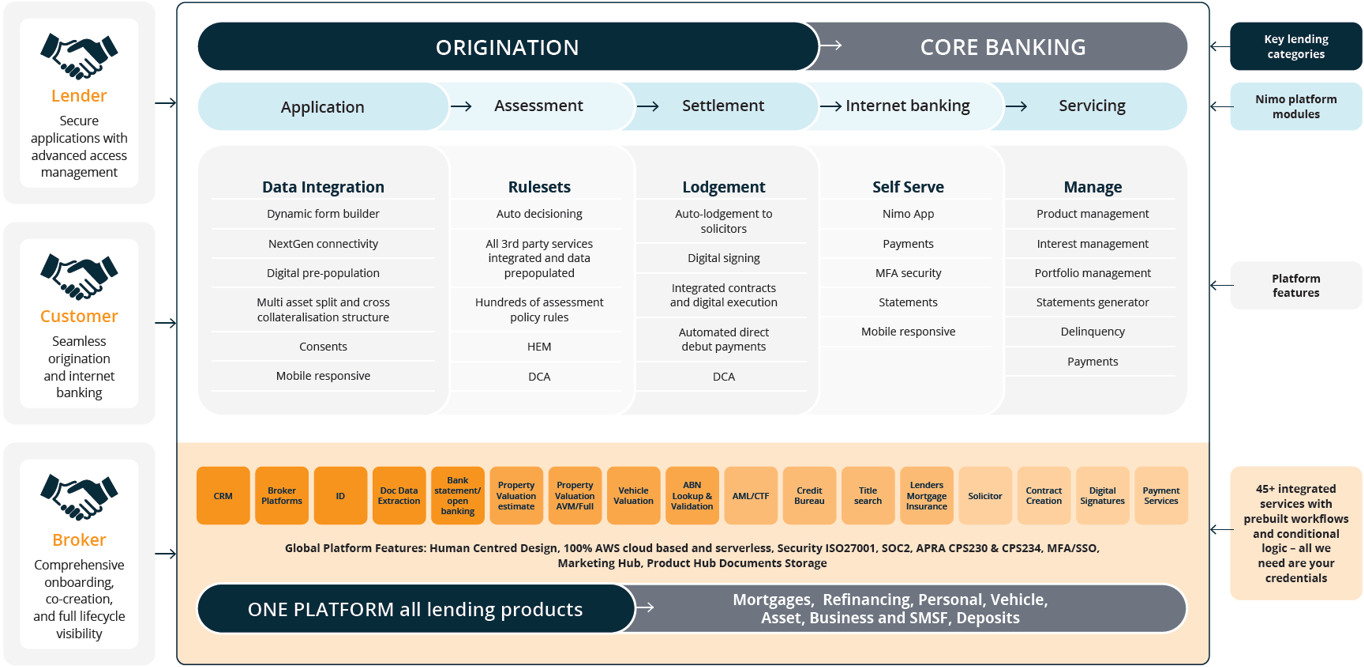

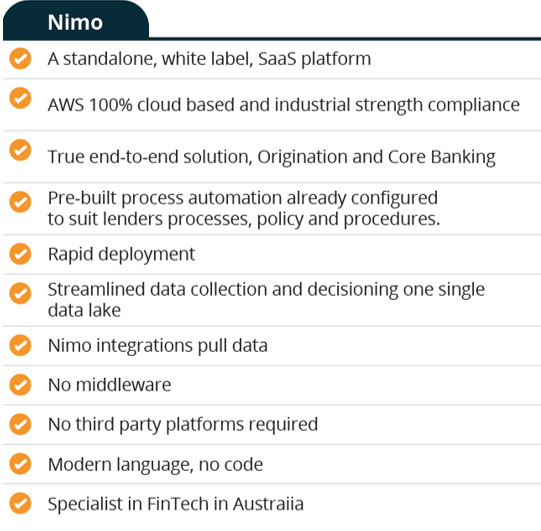

Nimo offers an online lending platform that provides a superior lending experience to your customers.

- A transparent and flexible origination process for customers

- An automated mobile-first online platform

- Easily configurable auto decisioning Assessment rules-engine

Nimo provides the following benefits to lenders:

- Low setup cost

- Lower the cost to originate

- Eliminate delivery risk

Build your online banking capability in stages

Nimo integrations

.. and more

100% serverless on AWS

Contact us now

Request your sandbox and we can have it ready in a day

Book a meeting

Simply pick a time to discuss your needs with us