Secure Messaging

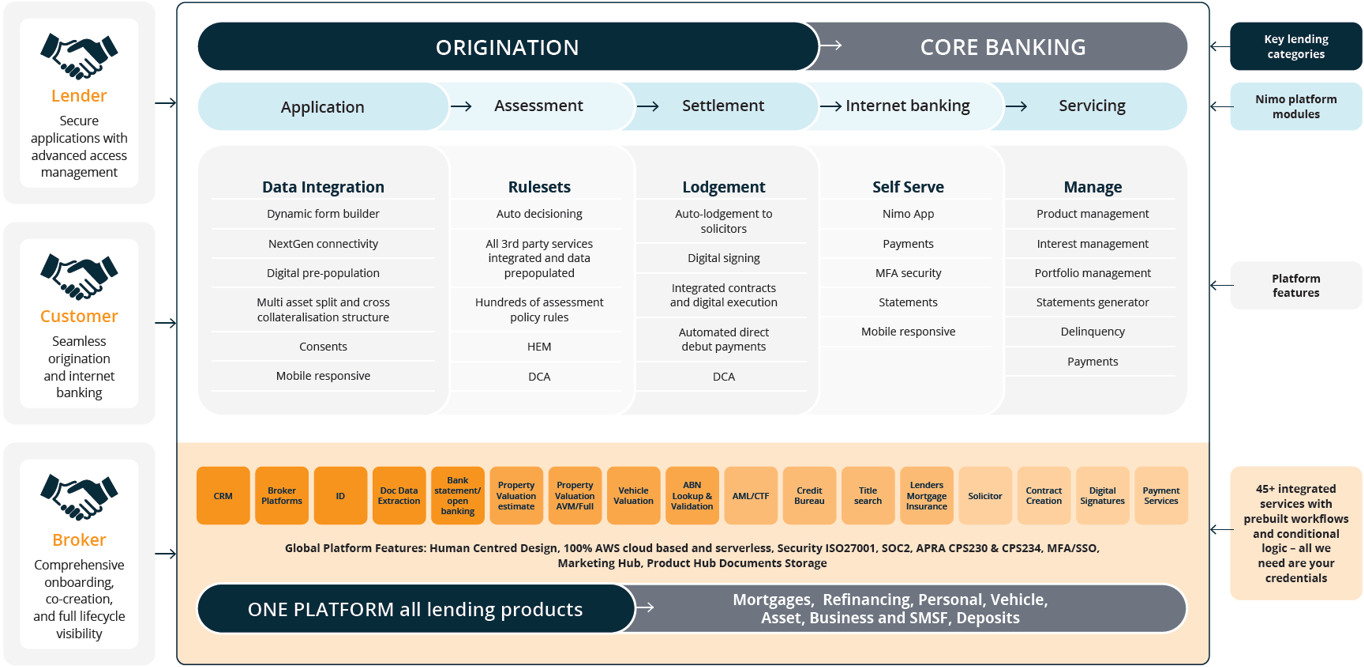

Nimo’s Core Banking solution is purpose-built for Lenders seeking a modern, scalable, and fully digital banking infrastructure. Our cloud-native, API-driven platform eliminates reliance on outdated legacy systems, delivering a seamless, secure, and automated experience from deposits to loan management.

With deep integrations into payments, credit control, and regulatory compliance frameworks, Nimo enables Lenders to reduce operational costs, improve efficiency, and enhance Customer engagement. Designed for both ADIs and non-ADIs, our Core Banking solution provides the agility needed to innovate, adapt, and grow—without the burden of expensive and fragmented systems.

Components

End to End

Run your entire Bank or Financial Institution on Nimo

Run your entire Bank or Financial Institution on Nimo

Origination

Fully digital and automated loan origination experience.

Fully digital and automated loan origination experience.

Broker

Provide Brokers with unparalleled capability and automation

Provide Brokers with unparalleled capability and automation

Integrations

50+ Industry leading integrations that work out-of-the-box

50+ Industry leading integrations that work out-of-the-box

Modules

Applications

Unrivalled customer experience via API and AI enabled online process

Unrivalled customer experience via API and AI enabled online process

Assessment

Automated credit decisioning and compliance configurable to your policy

Automated credit decisioning and compliance configurable to your policy

Settlement

Integrated digital contracting, Solicitor integration and disburements

Integrated digital contracting, Solicitor integration and disburements

Internet Banking

Flexible convenient and MFA secured online self-service banking

Flexible convenient and MFA secured online self-service banking

Product Management

Product lifecycle managment including pricing, contracting and features

Product lifecycle managment including pricing, contracting and features

Credit Control

Automated communication, fees, delinquency management and hardship

Automated communication, fees, delinquency management and hardship

More than ‘just’ the platform

Nimo brings together decades of financial services and lending experience with unrivalled digital expertise to transform lending origination and management.

Providing state of the art consulting and online lending solutions to Banks, Lenders and Brokers that is leading the industries transformation through partnerships.

Build your online banking capability in stages or all at once

Connect all your channels and customers with Nimo, either iteratively or with all from day 1.

Why Nimo

Increase operational efficiency

Deliver superior customer experience

Reduce regulatory risk and meet compliance requirements

Integrate into your existing systems

Award winning technology

2024 WINNER

Excellence in Consumer Lending

Fintech Australia Awards

2023 WINNER:

Best Home Loan Innovation

Australian Fintech Awards

2024 Women Leading Tech

2 x Category Finalists

Presented By Atlassian

2024 ‘Finnies’

4 x Category Finalists

Fintech Australia

2022 Awardee:

Best Industry Service

Australian Mortgage Awards

2022 Fast 50 Finalist

Rising Star

Deloitte Fast 50